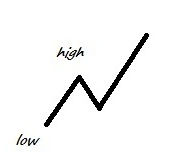

Foreign exchanging market consists of ups and downs in the prices and volumes in order to function as a market trade. There is no such thing as one sided direction move. In order to benefit from this equilibrium effect, we must choose the right moment to enter a trade. For example in a uptrend, why would you buy at a higher price when you can get it at a much lower price when it retrace. Fibonacci method is the most commonly used technique to calculate the possible extension and retracement of the trends in foreign exchanging market.

The Fibonacci important levels in retracement are 0.382, 0.500 and 0.618. For extension the important levels are 0.618, 1.000 and 1.618. (N%)

To calculate in uptrend:

Retracement = High - (High - Low) x N%

Extension = High + (High - Low) x N%

To calculate in downtrend:

Retracement = Low + (High - Low) x N%

Extension = Low - (High - Low) x N%

This method is a effective way of predicting the possible retracement and extension of the trend, but it might not always reach the calculated levels.

No comments:

Post a Comment