The exchanging market world in the past week for EUR/USD closed at 1.4312. Loss more than 600 pips with all factors against it.

Some factors that affected the EUR/USD pair:

- Trichet's code words stating that hike won't be seen in June, but more likely in July.

- Greek crisis accelerated.

- Fall in commodities weakened Euro.

- German factory orders dropped by 4% instead of rising

- USD positive NFP results.

- "strong doller policy" in Washington part of bank consideration delay hikes.

- Manufacture in good condition above 60.

- Possible GDP growth.

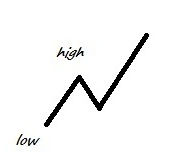

More factors are going to be release in the coming week to define the direction of movement of the exchanging market. I personally believe that pair will remain bearish from the uprising negative reasons on Euro and the broken uptrend channel.