As the market are closed during weekends, there is nothing much to say on the foreign exchanging market. I recently read some interesting tips on using the indicators, so i'll be sharing it on this

foreign exchanging market blog.

Indicators are basically mathematical calculation basing of the prices, volume or both nothing more. In

foreign exchanging market most indicators give information base on the price chart, so any supposition or signals found from an indicator can also be analysed from the price action analysis. Due to the complexity of the price action analysis in some price period, the indicators comes in handy.

This is the five tips in using indicator effectively in the

foreign exchanging market:

1.

Avoid using indicators that you cannot calculate by hand: Using indicators without knowing what the indicators calculation are based on is not going to help you analyse correctly. Resulting in failure, due to the lack of knowledge.

2.

Know your information needs: Many traders fill there screen with indicators without knowing how to use it. It is important to realize what you want to trade to find the information you need. For example if you are an intra day trader your indicator periods should be about 3-20 periods not 100-200 periods to know more precisely on the recent movements.

3.

Do not trade solely on indicators: This is one of the important factor that can determine success or failure in

foreign exchanging market. Every decision to enter a trade should be supported by both indicators and meanings. There is no prefect system such as when indicator RSI above 70 buy long position. Try to evaluate the meanings of the indicators through information and news to confirm your analysis. Not entering based on just either one.

4.

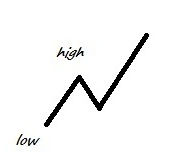

Be precise about your intension: Failure from indicator usage normally comes from the mistake in the way indicators are used. Most traders after trading for sometimes would come up with some strategies in using the indicators, but they lack the precision in using it. For example there strategies might work perfectly fine in a smooth uptrend, but not in a high steeping upslope.

5.

Do want price action analysis cannot do: Not the other way round. Using indicators to predict what price action can do better is not the way. Indicators should be used to tell beyond the PA with various results depending on how you use it. As indicators are based on pure prices and volumes, it have the advantage of lesser noise. Indicators would be of less use than PA when the direction of trends is clear. And of course it would be best to use both together.

This is just some tips and advice, which i found useful. Following this will not guarantee you success, but i hope it will make you a better trader.